Take steps to increase your credit score, lower financial obligation, carry out a spending budget and much more

What is Needed to Rating an extra Financial?

02/10/2024Advantages of FHA Money: Low-down Money much less Strict Credit rating Criteria

02/10/2024Take steps to increase your credit score, lower financial obligation, carry out a spending budget and much more

Although it should be an issue to shop for a house that have a lowered-than-mediocre earnings, there are some mortgage options and apps readily available that can assist have the ability. Why don’t we discuss how exactly to purchase a house having low income, just what things you can do to prepare and your financial possibilities.

Yes. There is not a particular minimal income to qualify for an excellent financial so there is actually various financing models and you may programs designed to help eligible consumers shelter a downpayment otherwise settlement costs. not, possible still have to plan appropriately for your monthly home loan repayments, insurance coverage, lingering costs and a portion of your down-payment and you will closing will set you back. Thinking ahead for these expenses is certainly going quite a distance in planning you for choosing and owning a home.

While thinking about to acquire property but do not possess an excellent high earnings, discover activities to do to set up oneself. Your revenue is not necessarily the merely choosing basis with respect to bringing home financing. Loan providers may also consider carefully your credit rating, debt-to-income (DTI) ratio, employment background and you can advance payment. And there are several financial options for low income consumers, also.

Optimize your credit rating.

Your credit score, or FICO Score, can range of 3 hundred so you’re able to 850. The higher the fresh get, the better when it comes to taking home financing. Locate a sense of where you stand, check your credit score and you may feedback your credit score to make yes it’s accurate. You have access to their declaration once a year at no cost from the annualcreditreport. When you’re a current You.S. Lender client, you should check your credit for free with your device. Constantly spend the debts on time and you can focus on repaying obligations if you’re looking getting a means to enhance your get.

Pay-off the debt.

Lenders scale your capability to repay what you use by comparing your debt-to-income (DTI) ratio. Your own DTI proportion ‘s the level of repeated financial obligation you have got, not including things like tools or cellular phone debts, in accordance with your own month-to-month money. It is calculated by using their full month-to-month loans money personal loan Dallas OR and you can isolating they by the gross month-to-month money. By the coming down your complete loans, you’ll be able to improve your DTI proportion.

Good principle is to try to opt for their home loan commission alone to get below twenty-eight% of the current revenues as well as your complete DTI ratio to help you be forty-five% or faster (including your mortgage payment). However,, you can qualify for a home loan that have a top proportion inside some cases, depending on their certificates. Instance, if you have a revenues regarding $31,000 ($dos,five hundred a month), the total credit card debt, vehicle and you may mortgage repayments cannot be over from the $1,125 30 days (45% regarding $2,500) together with your mortgage payment out of approximately $700 (28% of $dos,500).

Present a resources.

There are expenses that include to order a house. They’re down payment and you may closing costs, monthly mortgage payments, insurance rates and ongoing expenses such as repairs and repairs. Creating a resources and knowing how much you can afford to spend monthly can assist prevent you from using up more you can comfortably deal with. Think about your upcoming preparations, deposit selection plus the lingering costs off homeownership. Assets fees, homeowners insurance and you can resources is actually expenditures that will keep for as long as you own your residence, very keep in mind you to since you are planning.

Your own down payment represents the initially financial support in your home. More you can spend upfront, the reduced the monthly premiums and the shorter interest it is possible to shell out along the longevity of the borrowed funds. Whenever you rescue to possess a down-payment regarding 20% or even more, you’ll be able to inform you the lender that you are committed to the purchase and dedicated to and also make the mortgage repayments. In exchange, the lender can offer your a diminished rate of interest.

Whether or not a down-payment regarding 20% or even more has its own positives, discover mortgage possibilities which have reduced if any advance payment criteria (we will security much more about it from inside the another). Remember that with regards to the variety of mortgage you prefer and quantity of your own down payment, your We) or a mortgage premium (MIP). This type of manage the financial institution facing people losings if you’re unable to pay their mortgage.

Join the help of a co-signer.

Sometimes, an excellent co-signer might be able to explore its earnings and you can possessions to help you make it easier to qualify for home financing. The lender will consider the co-signer’s suggestions including your very own in deciding if or not you are recognized getting home financing. This cuts back your risk into the lender giving all of them individuals else to-fall back toward if you can’t create your monthly payments. But not, its value noting exactly what a massive obligations this can be getting good co-signer. Making your instalments on time might possibly be especially important to make sure its borrowing was secure.

First consider-time homebuyer programs.

If you’re a primary-go out homebuyer, there are a variety out of applications along the You.S. offering fund, provides, tax loans 1 or any other deposit guidance. They truly are readily available for eligible people who require help with downpayment or settlement costs. These software are supplied by the federal, condition, condition otherwise state enterprises, nonprofits or businesses. Supply and you can degree criteria are very different.

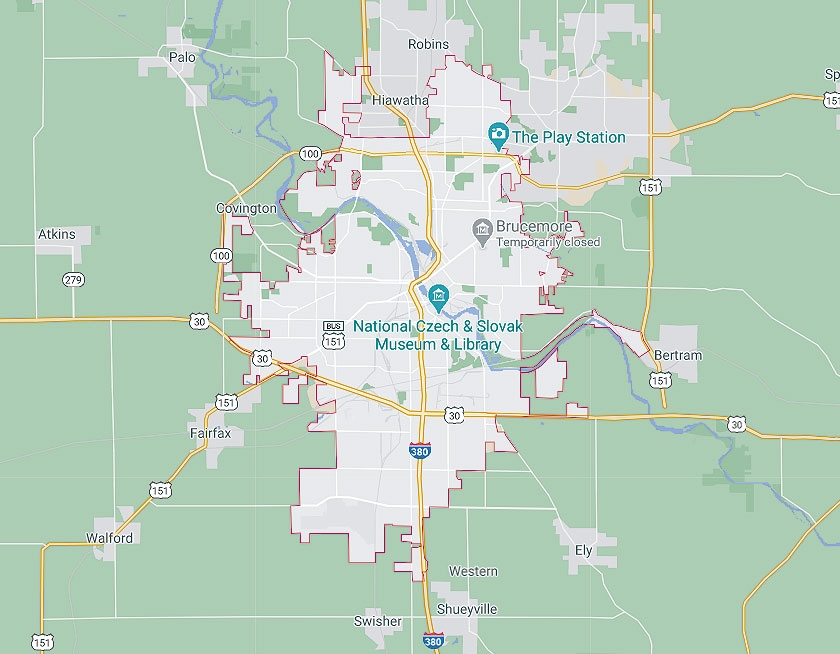

The new Western Fantasy program, provided by U.S. Financial, support customers that have limited resources getting property owners, especially reduced-to-average money (LMI) borrowers as well as in LMI communities. Apply at a good You.S. Bank mortgage officer to find out more from the apps offered near your.

Financial alternatives for lower-income buyers

Which have a low-income doesn’t automatically disqualify you from to acquire a great house. Check out of one’s loan available options to consumers with lower income:

- You Agency away from Agriculture (USDA) loans: To possess people with all the way down to help you moderate revenue interested in a house into the a qualified outlying area, a USDA mortgage is recommended. He could be zero advance payment financing which have low interest and you will normally have a lot more versatile borrowing criteria than conventional fixed-speed mortgage loans.

- Government Casing Government (FHA) loans:FHA mortgage loans try bodies-recognized funds one to typically have lower borrowing from the bank requirements than traditional fixed-rate financing and you will adjustable-rate mortgage loans (ARMs). He has got the absolute minimum down-payment from merely step three.5% and are generally offered to most of the accredited buyers, irrespective of income level.

- Pros Things (VA) loans: Having a beneficial Va financing, effective provider users, veterans and eligible enduring spouses can acquire a house with little to no or no downpayment. And also without advance payment, Va fund do not require home loan insurance. It can save you about this month-to-month expense as Va pledges a good portion of the loan.