FHA Financing Conditions to have Austin, Colorado and Travis Condition

Exactly what are the factors property may not violation a keen FHA evaluation?

17/11/2024Contained in this circumstances, the mortgage matter try $180,000 ($190,000 – $10,000)

17/11/2024FHA Financing Conditions to have Austin, Colorado and Travis Condition

FHA funds was in fact earliest delivered toward financial lending industries back in 1934 so that you can introduce important recommendations finance companies you are going to pursue that also was included with an authorities-recognized ensure. Before now addition, financing direction have been fundamentally throughout the chart and many possible home owners was omitted out-of homeownership considering the highest down costs expected and you may seemingly tight approval criteria.

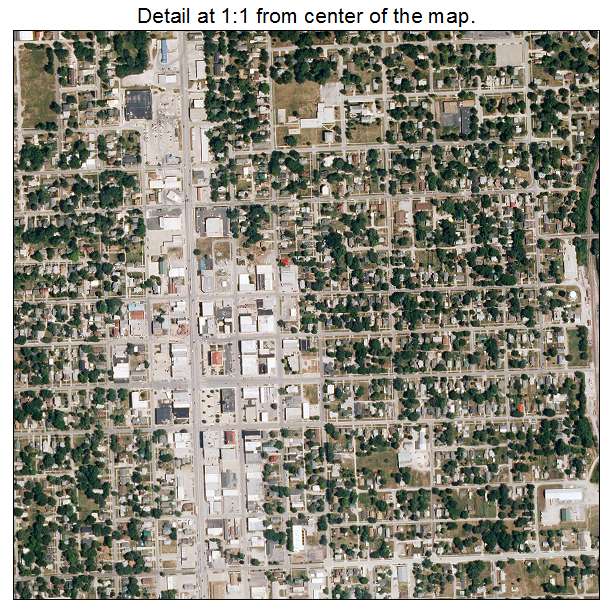

Over the years, FHA loans have developed into the one of the most attractive financial support alternatives during the Austin, Tx and Travis County. FHA ‘s the acronym towards Government Housing Administration.

Should the financing previously enter default and the possessions foreclosed abreast of, the lender is settled into the loss for as long as right FHA lending guidelines was basically implemented when the loan was initially approved.

FHA loans when you look at the Austin, Colorado are often used to money a primary residence merely and you may can not be accustomed money the next home or a rental assets because borrowers must consume your house being funded. FHA money can be used to loans an individual-house, an excellent duplex/triplex/fourplex so long as among the many tools is actually filled because of the new individuals.

Credit standards to possess FHA funds inside Austin and Travis Condition query to possess the very least credit score out of micro loans Cherry Hills Village 600 for a maximum out of 96.5% money. Whenever lenders processes an FHA loan application, they consult a credit report and you will credit scores out-of Equifax, Experian and you may TransUnion.

Per can give its very own credit score although such about three-little finger score vary from three hundred so you can 850 even though the 3 ratings might possibly be equivalent he or she is very barely equivalent due to various other resellers reporting more credit information at differing times on the some account.

Of about three scores, loan providers will get rid of a low and high scores and rehearse the center get to own being qualified intentions. If you have more than one debtor to the application, the financial institution spends a decreased of one’s middle results offered.

So it mortgage insurance rates will come in two versions, an upfront financial top that is folded to your loan matter and you will an annual premium that’s paid monthly

Down repayments to have FHA fund require at least good 3.5% down-payment regarding the borrower’s own financing. These types of financing may come out of an account this new individuals individual such as a discount or savings account plus the sorts of an economic present of a qualified provider particularly a close relative otherwise a non-profit service. For the a house revenue when you look at the Austin where the home is marketed having $3 hundred,000, the new advance payment amount try $ten,five-hundred such as. This really is an excellent option for first-date home buyers with minimal cashed stored.

FHA loans was completely reported, meaning that the lending company have a tendency to verify certain areas of the loan app through an authorized. Particularly, when verifying your earnings, the financial institution will inquire about your current income stubs you to definitely defense 1 month and your a couple newest W2 versions. If you’re care about-working, you will give the a couple newest federal earnings taxation statements, each other personal and you will organization output. The latest notice-working borrower might also be asked to provide annually-to-time profit-and-loss declaration.

Government entities-backed make sure comes with every FHA fund and in the type of a home loan insurance plan

In the long run, while FHA has got the financing guidelines financial organizations must pursue, FHA will not actually accept one loan application otherwise people factor of the financing, such as the property appraisal. Instead, the lender must follow the lending guidelines established of the FHA.

If you otherwise somebody you know is seeking that loan program which can be used almost everywhere, together with Austin, the fresh FHA loan program is going to be searched.

Get in touch with FHA Home loan Source for info of the contacting ph: 800-743-7556 or perhaps fill out the knowledge Request Function in this post.